For the second edition of ValueTeddy’s Snap Judgements we have Norwegian pharma and Polish computer games.

Photocure

Ticker: PHO

Market cap: 3300 m NOK

Revenue: 250 m NOK

For Photocure we have continuously growing revenues, relatively constant losses, and steadily declining book value of equity per share.

Since this is some sort of pharmaceutical company, I have absolutely no way of understanding the business. Looking at the latest financial statements we see a moderate decrease in sales from 280 m to 256 m, and a high gross margin. Furthermore, there has been a significant increase in sales and marketing costs, which turned a profit of 42 m in 2019 into a loss of 23 m 2020. There are also a very significant increase in both financial income and expenses which should warrant a deeper analysis. Only seeing the decreasing revenues even though sales and marketing spend is up causes me to pass on this stock, but for the sake of this analysis we will take a look at the financial position and the cash flows.

Almost all of the non current assets are intangible, but there is a large amount of cash in the balance sheet. Equity is 508 m, cash is 334 m, and total debt is 267 m. Looks to me like there was recently a new share issue to raise capital.

Moving to the cash flow statement we see a net positive cash flow from operations of 15 m, but a huge cash outlay of 166 m listed as “Payment return of market rights Europe”. I have no idea what this means but it should be top priority if you are looking to dive deeper into this stock. We also see that the capital raise was due to a private placement of 301 m. This is also cause for concern, IF this was done on less than market terms, because then they might be favouring some investors over others. I have no idea if this is the case, but you should look it up if you are interested in this stock.

If you know me, you should know why I am hard passing on this, but I’ll say it for the record. Pharma stocks and any kind of biotech/med-tech stuff is almost always a hard pass for me.

11 Bit Studios

Ticker: 11B

Market cap: 1300 m PLN

Revenue: 90 m PLN

Here we have something way more into my wheelhouse. I love computer games, and I know 11 Bit have created some critically acclaimed story driven games such as This War of Mine, and Frostpunk.

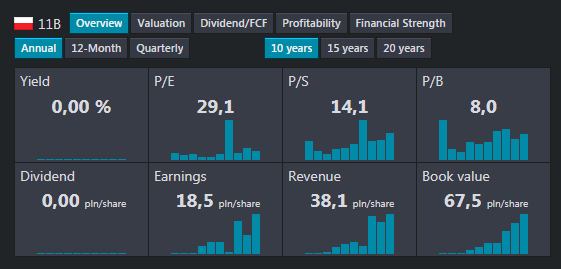

Looking at the numbers we see high growth in book value per share, and a significant jump in revenue per share a few years ago.

The following is all from the latest 10Q which concerns the nine months ended 30 september 2020. First thing I check when looking at video game companies are the revenues. In this case there are no capitalised costs and very little other income. Total revenue for the period is 68 m compared to 49 m same period 2019.

Total operating expenses are 33 m , and the largest line item is “services” at 19 m . This sticks out but these are detailed in the notes as costs related to sales of third party games and royalty payments, which makes sense. Furthermore, both financial income and financial expenses increased significantly, which should require some examination if you are interested in this stock.

Moving to the balance sheet, 11 Bit are well capitalised with about 160 m in equity versus 28 m in total debt. Most of the assets are constitutes 80 m in cash and 32 m of intangibles. The balance sheet looks good on first pass.

The cash flow statement also looks good with cash from operations of 47 m, up from 44 m. However, for the 9 month period regarding 2019 there are significant adjustments, which should be examined. Furthermore, there are highly unusual items in the cash from investing activities, such as loans to employees (~2 m), and some 7 m interest expense, as well as deposits and proceeds of bank deposits. There are also ~22 m of purchase of pp&e and intangibles that are not explained further. Finally, there seems to have been a share issue of about 7 m.

So, to sum up 11 Bit Studios: they make great games, and I’m sure there are more to come. However, there are lots of footnotes that need careful reading in the reporting regarding this case.

Parting words

So that was the second edition of this little experiment. I hope you liked it, and remember that none of this is financial advice and I’m not your financial adviser. If you want to suggest stocks for me to look at, you can tweet @ValueTeddy, and do check out valueteddy.com.