For this weeks edition of ValueTeddy’s Snap judgement, I am not making a snap judgement, but instead writing up one of my portfolio holdings. It goes without saying that since I own the stock I am biased, and that you should always do your own research. This is not any recommendation, and it is not a solicitation to buy anything. I’m not your financial adviser and I won’t take any responsibility for your actions.

That aside, we are looking at Nekkar, a Norwegian company who makes and sells ship lifts for shipyards and similar. Figures are in NOK from the 2020 annual report. Nekkar was previously named TTS Group, and have a history dating back to the 60’s. TTS was listed in 96 and after many transactions, the company was renamed to Nekkar in 2019 after selling the majority of what was left of the conglomerate. The business that is left today is vastly different from the business they had earlier, which can be likened to a shipping conglomerate. The business remaining is Shipyard Solutions, namely Syncrolift and Digital Solutions via Intellilift. Nekkar states that they are the market leader in ship lifts and ship transport solutions with a ~75% market share. They have about 200 installed systems and are also selling service and after market services.

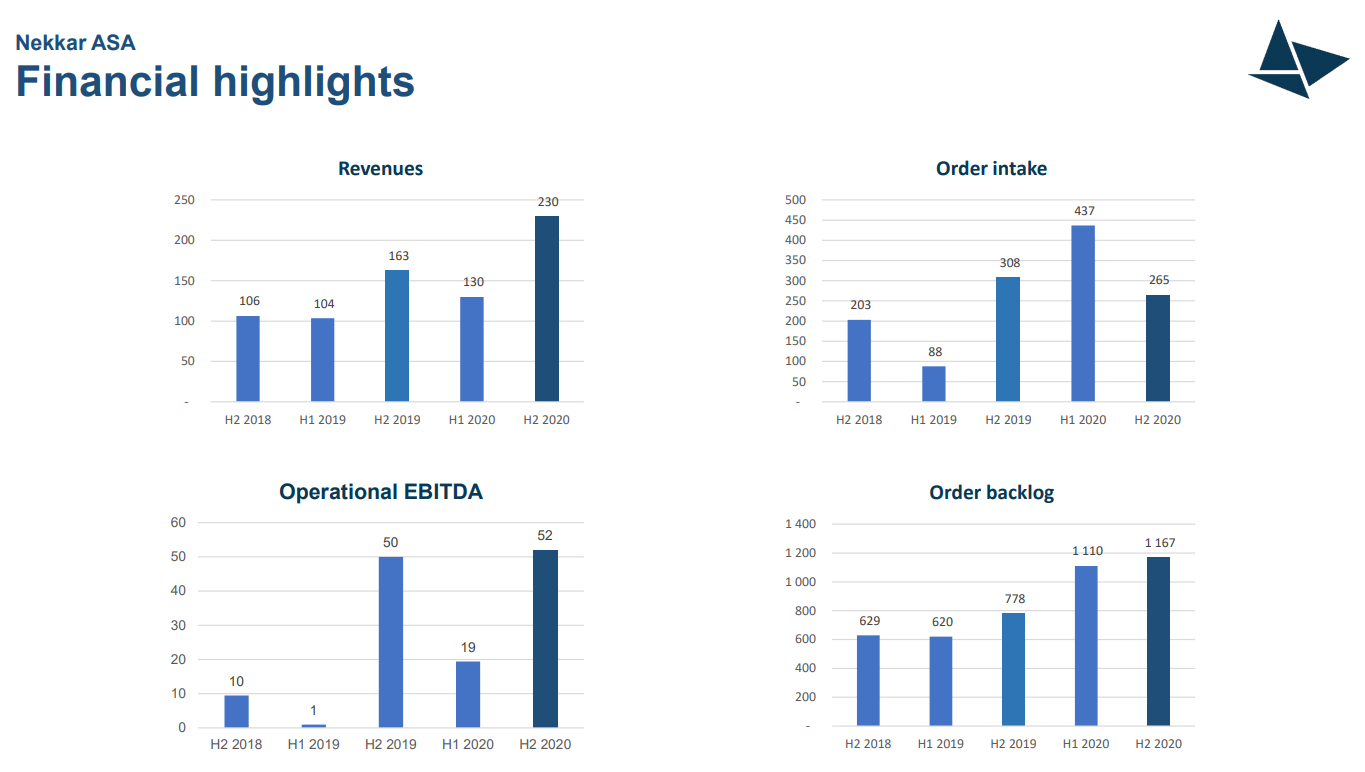

For the second half of 2020, revenues were about 230 m, up from about 160 m in H2 2019. Full year revenues are up from 270 in 2019 to about 360 in 2020, and revenues have been increasing since 2016. EBITDA margins were about 22% in 2020 which is a slight decline from 2019 margins of about 25%, but an increase from all years previously. Another measure that Nekkar presents is the order intake and backlog, for the full year 2020 order intake is up to 700 m from 2019 levels of 400 m. The order backlog exiting 2020 was higher at 1160 m than exiting 2019 at 780 m. The majority of the increase in backlog was seen moving from H2 2019 to H1 2020.

Moving past the presentation numbers into the earnings report, for the full year 2020 we see 360 m in revenue, 200 m of COGS, and say 95 m in other operational costs. This leaves 77 m of operating profit, or 21% operating margin. Remove 2.7 m of depreciation and 3 m in net financial cost, leaves us with about 71 m of pretax operating profit. for 2020 Nekkar paid less than 1 m in tax, but there is a one-time loss from discontinued operations of 104 m related to a settlement with Cargotec who bought a part of Nekkars business during 2018.

Moving to the balance sheet, Nekkar carries about 350 m of debt against 200 m of equity. Most of the debt is 190 m in pre-payments from customers, and 128 m in other current liabilities. Most (94 m) of the “other current liabilities stem from the Cargotec settlement. Nekkar have 6 m of property, plant & equipment, and they hold 460 m in current assets, of which 367 m is cash. Note that about 90 m of the current assets are pledged as collateral, which leaves Nekkar with about 28 m of cash available to shareholders.

Moving on to the cash flow statement, Nekkar has 134 m in operating cash flow, of which 56 m is changes in working capital. of this, 12 m was used in acquiring fixed or intangible assets, and 14 m cash outflow related to a sale of discontinued operations. Nekkar does not pay a dividend, and total net financial items paid was about 3.5 m.

In summary, Nekkar has what I would call a good business with great cash flow margins, and a solid balance sheet. 360 m of revenue resulting in 77 m of operating profit and 130 m of operating cash flow, low debt level, and a backlog of over 1 b.

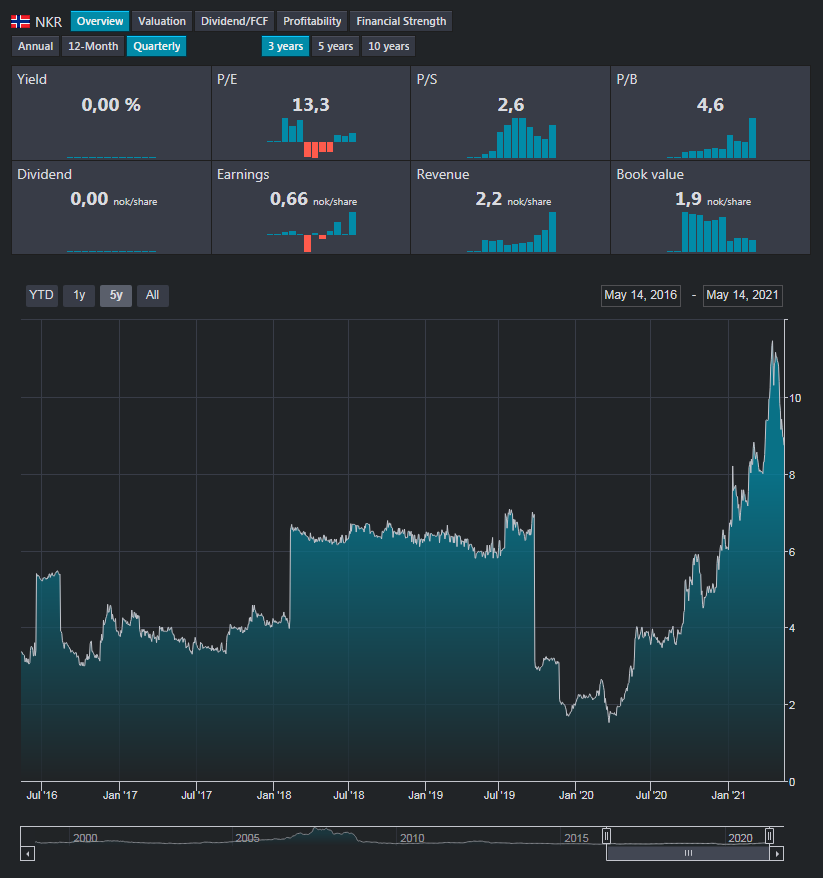

At a market cap of 950 m and net current assets of 118 m, we get an EV of about 830 m, which gives us EV/S of 2.3 and EV/Operating profit of about 11.

This is what I call a good base to build from, and what are they doing with the cash? Nekkar announced that they are currently pursuing two new avenues for growth, first a solution called Starfish, aimed at the aquaculture industry, and one towards renewable energy solutions. The first is an automated cage for fish farming, supposed to significantly reduce operating costs for the aquaculture industry, and improve harvesting by reducing risk for stuff like sea lice and escapes. This is currently in testing with Lerøy, and is partially funded by Innovation Norway. Regarding the renewables solution nothing much is announced other than that there is a pre-study completed with an unnamed partners, and patent undergoing approval.

Since they just started a pilot with Starfish together with Lerøy in H1 2021 I assume there is still quite some time before real rolling out, but I hope to see some updates regarding this in each report. The renewables leg seem to be much further out, and I don’t expect any revenues from renewables in at least three years. For Starfish, I would hope to see the first real revenues in early 2022, but this is just pure guesswork. These two legs of Nekkar should probably be seen as two options for possible growth, and I believe there is good possibility for Nekkar to make one of these into a good business.

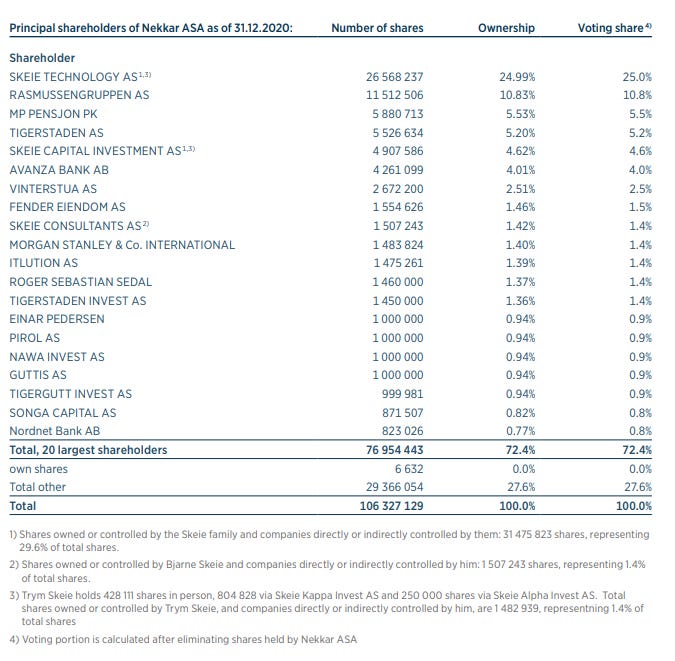

Finally, the largest owners are Skeiegruppen with a total ownership of more than 30% and Rasmussengruppen with about 10%. Skeiegruppen is represented by the Chairman of the Board Trym Skeie, and Rasmussengruppen is controlled by Gisle Rike who is on the board of directors.

That’s it, I think Nekkar is a great case, and it is one of the largest positions in my portfolio. To me, Nekkar looks like a growing business with good potential for reinvestment of cash flows, and have a great balance sheet. Large holdings by insiders, and the wet blanket regarding the Cargotec deal from 2018 has been lifted. I like the stock at the current valuation, even though it has had a massive run up during the last year.

I hope you liked this weeks edition of ValueTeddys Snap Judgements, and remember that none of this is financial advice and I’m not your financial adviser. I want to remind you that I own this stock and am therefore of course biased. I would love to hear your remarks on this, and remember to do your own research and don’t buy or sell anything based on what you read here. If you want to suggest stocks for me to look at, you can tweet @ValueTeddy, and do check out valueteddy.com.

Edit* I had originally overestimated the cash position when this was originally posted and have since corrected the balance sheet and EV section of this analysis.

I think by correcting the balance sheet and EV section you’ve actually made it worse! In Nekkars case the Enterprise value is calculate as follows: Equity Value – Cash + McGrecor settlement + minority interest. There is no need to add back Unearned/Deferred Revenue.

In my opinion, the adjustment makes it more conservative regarding the cash position. It is clear that Nekkar has more assets than debt, and the long term assets are small and funded by long term liabilities, so the net position could be shorthanded by taking current assets – current liabilities. Which is what I have done regarding the EV calculation. (market value of equity + market value of debt – net cash). This is fairly conservative, and if you want to take it to the other extreme, none of the debt on Nekkars balance sheet is interest bearing debt, so you could argue for calculating a significantly lower EV.

When looking at cash available to the shareholders (and to be used freely by the company) on has to take into account the fact that some of the cash / receivables are pledged as collateral. I hope that answers your comment 🙂