This is going to be the first update of a previously written up stock on ValueTeddy’s Writeups. Nekkar is a relatively long term holding of mine, and I wrote about it on 17.05.2021 at a price per share of 8.75 NOK, or a 950 m market cap.

On the 17th of February 2022 Nekkar released their fourth quarter figures for 2021, which gives us the full year numbers for 2021, and I thought it fitting to write an update on the case. I originally posted some comments on the Q4 on twitter in this thread here.

Even though the business is moving along nicely, the shares currently trade around the same price as when I wrote about Nekkar in may of last year.

Business

The business is still largely the same as when I initially wrote about the company, so this will be some repetition of what I originally wrote. All figures will be in m NOK.

Nekkar’s main business is shiplifts under the Syncrolift brand. They also have digital solutions under the Intellilift brand. Syncrolift is offered as an alternative to dry docks by lifting the ships onto land for maintenance and repair. Nekkar point to it being less limited regarding ship size and having more efficient utilization of space. Intellilift is “leading the way in data driven performance improvements for the offshore energy and other sectors”. Intellilift offers cross systems communications solutions, digitalization, and robotization mainly of the offshore drilling business. Intellilift is by far the largest segment in Nekkar contributing more than 90% of the groups revenue and earnings in both 2020 and 2019. I expect the same to be true for 2021 but I can’t confirm this until we the annual report is published.

The order intake for 2021 was about 100 m, almost all of which came in the second half of the year. The total order backlog was about 840 m, or close to two times the full year revenue. Nekkar also proudly point to the significant growth in revenue from aftersales/service, increasing from less than 35 m to more than 45 m for the full year.

Other than the main business, Nekkar has three growth initiatives. These growth initiatives are, in order of expected commercialization:

1. Starfish

2. Skywalker

3. Intelliwell

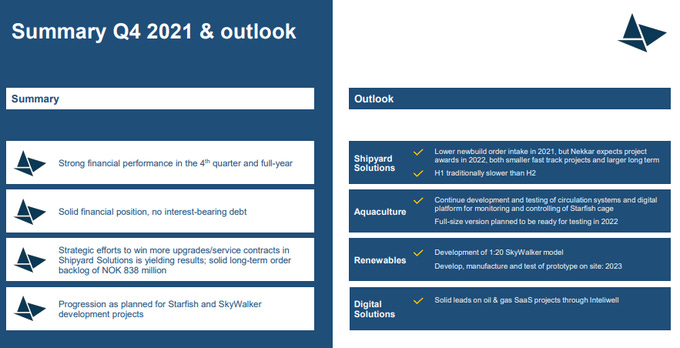

Starfish is their attempt to create automated cages for seafood farming, which are intended to lower capital expenditure for fish farming companies, and to decrease the risk of disease and lice for the fish. Starfish is currently in a small scale (1:2.5 scale) testing stage, and full scale testing is planned sometime during 2022.

Skywalker is further out, and it is their attempt to create an alternative method of installing wind turbines. It is currently at a 1:20 scale model testing stage, but is reportedly proceeding according to plan. On site prototype testing is expected sometime during 2023.

Intelliwell is a joint venture with Transocean, the worlds largest offshore drilling company, which was announced shortly before the Q4 was released. There is no timetable for this project yet, and I expect that it is further out than Skywalker.

Financials

The 2021 full year results are as follows, figures in m NOK (2020 in parentheses):

Revenue: 480 (359)

EBIT: 135 (75)

Earnings: 111 (70)

Operating cash flow: -62 (133)

Free cash flow: -88 (121)

First of all, I note an increase in revenue by 33% and an increase in EBIT and Earnings by 80% and 60% respectively. Albeit impressive, my understanding is still that the revenue is largely based on how quickly Nekkar can work down the large backlog. More noteworthy is that the large operating cash flow and free cash flow turns negative for the full year 2021. This is explained by the fact that the company received very large prepayments during 2020 which was converted to revenue during 2021. The change in prepayments represents an outflow of more than 140 m. The capital expenditures for 2021 were about 26 m, and the cash from investments were heavily impacted by the settlement with Cargotec / MacGregor, causing a one time cash outflow of close to 100 m.

The balance sheet is still in great shape, with no interest bearing debt, and a total net cash position of 180 m. Total liabilities of 135 m represents less than half of the total current assets at close to 360 m.

Valuation

At the current price of 8.55 NOK the market cap is just north of 900 million. Adjusting for the net cash position of 180 m gives us an enterprise value of 575 m, and the following multiples:

EV/EBIT: 4.5

P/E: 8

Outlook

I always appreciate the following table summarizing the quarter and giving us some expectations regarding managements outlook for the nearest future.

Regarding the core business Nekkar expect some new orders during 2022, but they also tell us that H1 is slower than H2. I don’t expect any massive new orders during H1, and I expect some order intake during H2. Given the large backlog it is not the end of the world if there are not that many new orders during 2022.

Other

Nekkar’s largest shareholder is Trym Skeie who has been Chairman of the board since 2009. He controls about 30% of the capital. The second largest shareholder is the Rasmussen family who control about 10% of the shares and has a director on the board. Another notable director on the board is Marit Solberg, for her connection to the seafood industry. She has had a long career in the seafood industry, including 8 years as COO of Farming at Mowi (previously named Marine Harvest). In 2018 she retired and got a seat on Nekkar’s board of directors in 2019. She serves on a couple of boards, all seemingly related to seafood, and also happens to be the sister of Erna Solberg, who was Norways Prime Minister from 2013 to 2021.

It was announced in January 2022 that the interim CEO Preben Liltved will step down and take the role of Executive VP of Operations, as the new CEO Ole Falk Hansen will take over in July 2022. Falk Hansen comes from a five year tenure as CEO at a company called Beckmann, who makes backpacks. Previous to that he served as CFO at MHWirth, an international drilling technology company, and at Aker Solutions, where he held the role as Head of Strategy and M&A for the drilling business. I don’t immediately see the move from drilling to backpacks and now to Nekkar as easy to explain, but Trym Skeie speaks highly of him in the press release: “We are pleased that Ole has accepted the role as CEO, and I must confess that we have tried bringing him on board for some time. Ole brings on valuable skills and experience within management, finance, strategy and business development. Furthermore, he has solid understanding of the ocean-based industry domain that is core to Nekkar’s business offering”.

Preben Liltved holds an insignificant amount of shares, and we will have to see if Ole Falk Hansen will purchase any shares as he enters the CEO role. Furthermore, Rolf-Atle Tomassen, CEO of Syncrolift AS sold his small shareholdings of 150 thousand shares to Skeie in december 2021. Lack of management shareholdings is never a good thing, but at least we have some skin in the game from Skeie.

Conclusion

Since we have seen progress in the growth parts of the business, and the balance sheet and backlog are still healthy, my opinion of the fundamentals in the company remain unchanged. Since the valuation is lower than when I first wrote about the company I still remain positive regarding the risk/reward from here and I still own shares of Nekkar.

I hope you liked this edition of ValueTeddy’s Write-ups! If you want to suggest stocks for me to look at, you can tweet @ValueTeddy, and do check out valueteddy.com. Please note that this is in no way a recommendation or financial advice and I’m not your financial adviser. Nekkar represents about 11% of my portfolio at the time of writing.